Osborne is announcing his #Budget2016 on Weds, and there’s lots of pressure from the oil barons for more subsidies and tax cuts. Their income has been hit by the falling oil price, and in all those years of bonanza profits they never thought to save for this rainy day (even though it was predictable given the mostly cyclical oil price…)

Osborne is announcing his #Budget2016 on Weds, and there’s lots of pressure from the oil barons for more subsidies and tax cuts. Their income has been hit by the falling oil price, and in all those years of bonanza profits they never thought to save for this rainy day (even though it was predictable given the mostly cyclical oil price…)

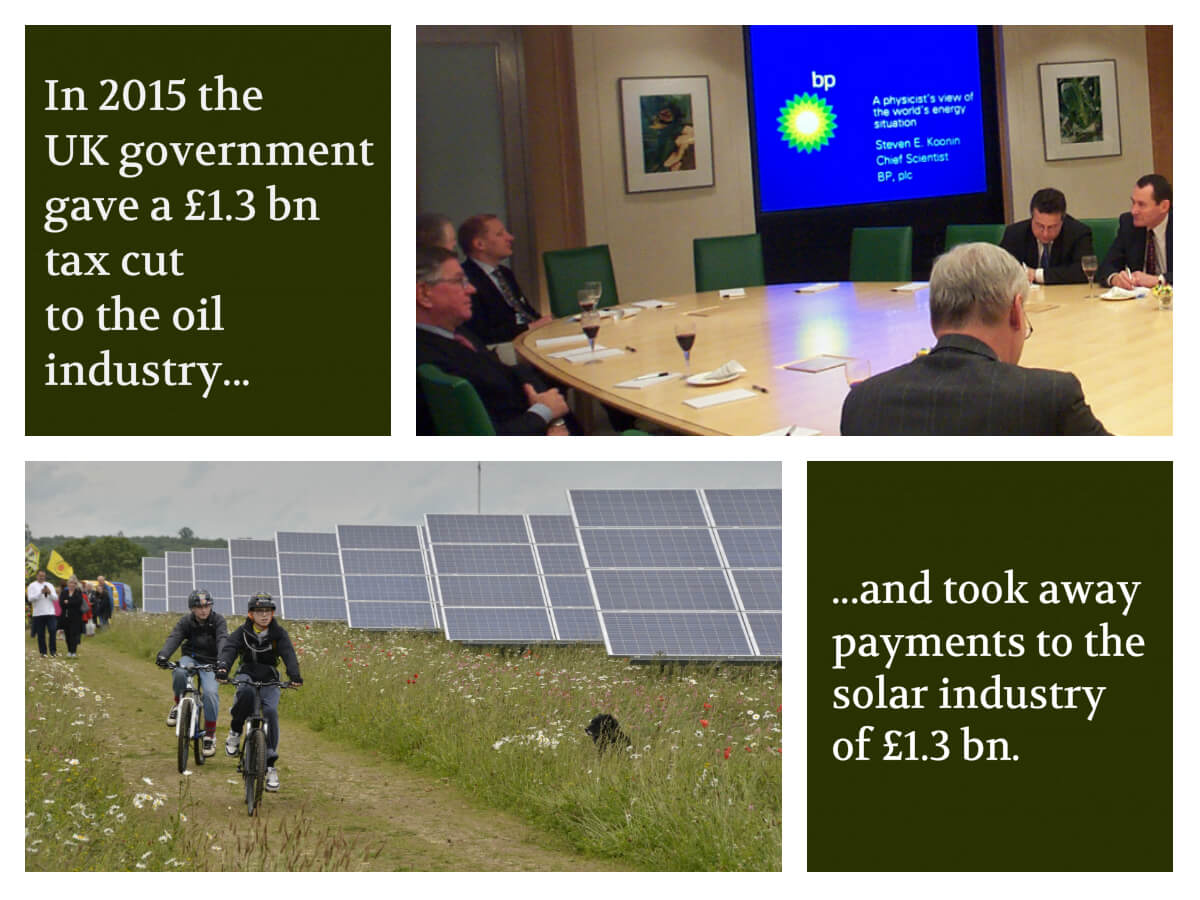

The oil companies already received £1.3 billion in extra handouts in the 2015 budget, just months before the government demolished the renewables support – also to the tune of £1.3 bn. This didn’t stop BP, Shell, Total and others slashing 5,000+ North Sea oil jobs.

The intense lobbying has skewed public debate – with most journos buying into a narrative of ‘poor struggling oil companies’ and ‘tax breaks that will save jobs’.

So we put together a short snappy #OilTaxFacts briefing, to correct the spin. Our 6 Facts make clear why it’s time the public stopped subsiding the oil barons.

Obviously, many jobs are being lost in the North Sea, and that’s a big problem. But the subsidies aren’t fixing that.

Instead of giving handouts to oil executives and driving a race-to-the-bottom, we should be putting money into infrastructure and a transition to clean energy, guaranteeing long-term decent and public jobs and public benefit.

A better future for the North Sea is possible. More and better jobs. A safer and more stable economy. Stronger communities. A long-term future as an energy exporter. That better future won’t come with tax cuts for oil corporations and trying to extract every last barrel. It means changing direction and building a new economy. (See Energy Beyond Neoliberalism for more detail)

Our Six Facts

FACT #1 Subsidy changes are destroying more jobs in solar than saving in oil

The slashing of support to solar power in 2015 is causing the loss of up to 18,700 jobs, according to government figures. The government has not estimated the jobs impact of the oil tax breaks, though industry representatives have suggested some wild figures as part of their lobbying strategy. The low oil price contributed to 5,500 people losing their jobs in the year before Sept 2015, and corporate estimates predict a further 11,000 job losses. In other words, 16,500 North Sea jobs are at risk, despite government subsidies.

The amounts of money are almost identical: in 2015 the government gave £1.3 bn over five years to the oil industry, and took away payments (by consumers) to the solar industry of £1.3 bn over six years.

Sustainable sectors can employ more people than currently work in fossil fuel industries. Calculations show that industries like wind, wave and tidal and could employ 40,000 more North Sea workers than the existing fossil economy. Competitive advantage in solar would create long-term jobs in a growth industry, rather than trying to hold back the decline of UK oil production.

FACT #2 The UK oil industry is highly profitable over time

Government statistics show that oil companies in the UK North Sea made a vast 33% rate of return from 2008 and 2014. Companies in other sectors (excluding banks) averaged 10% over the same period. While this was down to 5.3% in the first 3 quarters of 2015, it would have to stay at this level until 2022 for the 10-year average to match that of other industries.

A common-sense approach might have been for the industry to put some of this excess profit away for a rainy day, as the oil price is known to be cyclical. Instead the industry wants to enjoy super-profits when the price is high, and for the taxpayer to take the pain when it is low. Throughout this period of high profits, the industry “cried wolf”, as admitted by Oil & Gas UK in Feb 2016. For example, after the tax rise in 2011, OGUK said, “This change in the tax regime will decrease investment, increase imports and drive UK jobs to other areas of the world”. In reality, investment increased from £5.5 bn in 2010 to £11.8 bn in 2012, employment increased and the decline in production slowed.

FACT #3 The UK oil industry pays less tax than in other countries

Oil revenues are projected to average £0.7 bn a year for the next five years, just 1% of total government income. The oil industry has claimed that it pays more tax than other industries, which pay only corporation tax of 20%. This claim is highly misleading, because oil taxes constitute public income from resources that legally belong to the state (whereas corporation tax is an income tax on business profits).

In fact, the UK takes a lower share of revenue from its oil resources than most other countries. On average, governments receive 72% of net revenue from oil production, compared to 50% from most UK fields. Norway, operating in the same fields in the North Sea, takes 78%.

In spite of the already-low rates of tax, the government already gives £6 bn in tax breaks and allowances to further reduce the industry’s contribution.

FACT #4 Oil tax breaks do not protect jobs

Subsidising oil companies is not an effective way of protecting jobs. Scottish unions announced recently that despite tax breaks, oil companies had “not passed on that relief to their workers, whose jobs are being slashed.”

The industry suggests tax cuts and cost reductions (especially job losses) can go hand- in-hand. Even after it got what it asked for with Osborne’s £1.3 bn subsidy in 2015, lobby group Oil and Gas UK moved quickly to warn that jobs would still be lost. Just one week after the Budget, Shell cut 250 UK jobs, stating, “Reforms to the fiscal regime announced in the Budget are a step in the right direction, but the industry must redouble its efforts to tackle costs and improve profitability”. Other companies followed suit in the subsequent months.

As the chart above shows, the major historical tax cuts did not lead to higher employment, nor did the tax rises reduce it.

Premier Oil, which owns interests in eight producing fields in the UK, says, “Lowering the tax rate at this point is not going to make much difference – it’s just going to mean that some of the international majors are able to pay even less tax.”

FACT #5 Oil subsidies are internationally agreed to be a bad idea – even by Cameron

There is international agreement – including from the IMF and OECD – that fossil fuel subsidies must be ended urgently, as a priority step in addressing climate change. At the 2014 climate summit in New York, David Cameron described fossil fuel subsidies as “economically and environmentally perverse”, as they “distort free markets and rip off taxpayers”.

While the government may try to claim that tax breaks are not subsidies, the most accepted international definition of subsidies – by the World Trade Organisation, adopted by all WTO member states, including the UK – is explicit that they are.

FACT #6 Government policy is doubly slowing the clean energy transition

When ending support for wind and solar energy last summer, Energy Secretary Amber Rudd said “We need to work towards a market where success is driven by your ability to compete in a market, not by your ability to lobby government.” By applying this logic to renewables and not to oil, the government doubly holds back the clean energy transition: renewable energy growth is retarded, while further subsidies for oil and gas strengthen their competitiveness against clean energy.

The government estimates that the cut in feed-in-tariffs will reduce the number of new rooftop solar installations over the next six years from over 1 million to 200,000 (compared to the existing 750,000). Conversely it estimates that the tax breaks for oil in last year’s Budget will boost oil production in 2019 by 15%. In both respects, it is the opposite of the incentives needed to address climate change.

Here’s the pdf of the Oil Tax Facts-sheet.