We’ve engaged in a lot of AGM activism over the years, mainly on Shell, BP and RBS, and we’ve been privileged to work alongside many different visitors from impacted communities who’ve come to these AGMs to speak ‘truth to power’. In recent years there’s been some really powerful interventions from people from Gulf Coast Communities devastated by BP, indigenous communities impacted by Shell’s activities in Alaska, and First Nations folks from Canada coming to tell RBS to stop providing finance to companies engaged in tar sands. On 24th of October, controversial mining giant BHP Billiton is going to be receiving a visit from a very different sort of shareholder activist who’s looking to make some waves in the equity-finance community.

We’ve engaged in a lot of AGM activism over the years, mainly on Shell, BP and RBS, and we’ve been privileged to work alongside many different visitors from impacted communities who’ve come to these AGMs to speak ‘truth to power’. In recent years there’s been some really powerful interventions from people from Gulf Coast Communities devastated by BP, indigenous communities impacted by Shell’s activities in Alaska, and First Nations folks from Canada coming to tell RBS to stop providing finance to companies engaged in tar sands. On 24th of October, controversial mining giant BHP Billiton is going to be receiving a visit from a very different sort of shareholder activist who’s looking to make some waves in the equity-finance community.

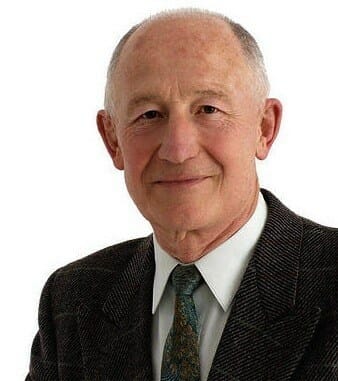

Ian Dunlop isn’t an impacted community member or an NGO professional, and he’s certainly not a hippie. In his bio he describes himself as having, “wide experience in energy resources, infrastructure, and international business, for many years on the international staff of the Royal Dutch Shell Group” and having “worked at director and CEO level in oil, gas and coal exploration and production, in scenario and long-term energy planning, competition reform and privatization.”

BHP Billiton is an Anglo-Australian multinational mining and petroleum company – the largest company in Australia and the ninth largest company listed on the London Stock Exchange, and its various environmental and human rights controversies all over the world have been well documented by London Mining Network and others. So you’d think that a man of Ian Dunlop’s skills and experience would be a prime candidate to be sitting on the board of BHP Billiton.

And it probably would be a match made in heaven if he wasn’t seeking election to the board on the uncomfortable issue of unburnable carbon and climate change. Ian Dunlop explains why people should support his nomination:

The greatest challenge the world and BHPB faces is climate change caused by fossil fuels. We risk potential global temperature increase above 4 degrees. Extreme weather disasters, sea level rise, disease, food and water scarcity, and social conflict would ensue. No business is possible in a world of 4 degrees warming.

The Board of BHP Billiton has a fiduciary responsibility to objectively assess these risks and take action to manage them.

No more than 20% of existing fossil-fuel reserves can be burnt if the world is to stay below 2 degrees of warming. Action is needed to ensure BHPB: (a) is not exposed to write-downs from the loss of value of fossil-fuel assets and (b) can prosper in a carbon-constrained world.

If such investment continues, substantial destruction of BHPB shareholder value is likely as climate change impacts intensify and fossil-fuel projects become stranded assets.

The issue of unburnable carbon reserves and their financial implications has gained a lot of traction through the excellent work of Carbon Tracker, Share Action and similar initiatives, but this is one of the first times that the issue has been so clearly and publicly articulated to the industry from such a credible ‘insider’.

When challenges are made to company operations at AGMs on environmental grounds, the response is more often than not a forced but polite smile from the board, and some bland rehearsed lines that evade the issue, with a subtle subtext of “no one’s really taking these hippie/leftie/do-good-er types seriously”. So it’s going to be interesting how the board and fellow shareholders deal with someone who’s articulating this position and who also comes with a lifetime of insight and experience into the workings of this particular sector.

I’ve included “sort of” in the title of this blog because it’s necessary to acknowledge that this is an important challenge, but a limited challenge. It’s all about carbon, climate, and what the potential impact that will be on value for shareholders. It’s speaking a language that shareholders, motivated by share value, will be receptive too, but the challenge doesn’t encompass anything to do with the impact that BHPB is having on communities all over the world.

There are more visitors who are coming to address the BHPB board at the AGM. Yasmin Romero Epiayu is a well-known activist from the department of La Guajira in the north of Colombia. She is an Indigenous Wayuu woman from the Epiayu clan, known for its dedication to the protection of Mother Earth and the defence of their Indigenous rights, especially their right to their ancestral territory.

In recent years the Cerrejon coal company, co-owned by BHP Billiton, has been conducting opencast operations in Wayuu territory. The Wayuu see this as a form of digging up Mother Earth’s vital organs, and as a violation of their Indigenous rights. Yasmin Romero Epiyau, working alongside World Development Movement and London Mining Network is coming to articulate the Wayuu rejection of the Cerrejon coal mine – the climate impacts, the water and air pollution and the forced evictions that have taken place.

In recent years the Cerrejon coal company, co-owned by BHP Billiton, has been conducting opencast operations in Wayuu territory. The Wayuu see this as a form of digging up Mother Earth’s vital organs, and as a violation of their Indigenous rights. Yasmin Romero Epiyau, working alongside World Development Movement and London Mining Network is coming to articulate the Wayuu rejection of the Cerrejon coal mine – the climate impacts, the water and air pollution and the forced evictions that have taken place.

Of course, Yasmin Romero Epiayu isn’t a White, Western male with a corporate background, so is unlikely to be afforded the same degree of credibility that will be given to Ian Dunlop. So here’s hoping that using the financial frame of unburnable carbon in the context of the BHPB AGM can be used as a wedge to open political space around issues of environmental justice and impacted communities.