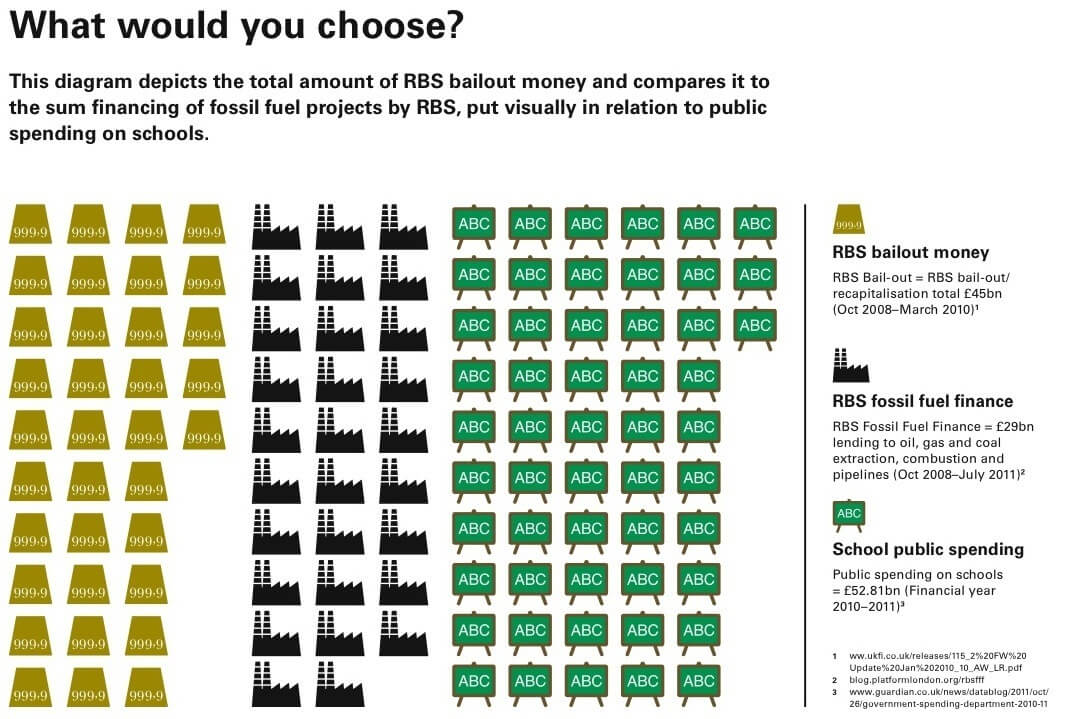

This article first appeared in the March 2012 edition of Ethical Consumer magazine. Alongside was featured Lisa Isfits' infographic on RBS fossil fuel finance, 'What would you choose?'

The Royal Bank of Scotland has been trying to claw back some level of acceptable public image after a wide range of misdemeanours. Beyond the bail-out, the bank’s finance of fossil fuels has brought a cacophony of criticism over the past five years – from students kicking RBS off campus, to an attempt to sue the Treasury for failing to prevent public money servicing finance to the fossil fuel sector.

Platform has been involved in raising the pressure on RBS, and have seen the bank style a number of strategies to cover up its dirty image. In 2011, we saw one such attempt backfire for RBS. At the beginning of the year, the bank was a main sponsor of a national event that involved hundreds of broad-ranging organisations, Climate Week. By the end of the year, it had been dropped.

As Climate Week launched in March 2011 Platform published ‘Dirty Money – Corporate greenwash and RBS coal finance’. It highlighted the tension between RBS’s coal finance and its attempts at garnering climate credibility. The organisers of the event were embarrassed by headlines such as ‘Green groups boycott Climate Week over RBS’. A number of high profile figures including Alastair McGowan and Iain Banks signed a letter in the papers that flagged up RBS’s record in providing coal and tar sands-related finance. McGowan commented, “It’s high time RBS put its money where its mouth is, and stopped bankrolling the fossil fuel industry.”

Platform coordinated a letter that was sent to all the hundreds of different groups signed up to take part in the event, and arrivals at the Climate Week awards in Central London passed a throng of climate change protesters from the UK Tar Sands Network. The publication Dirty Money showed that in the years 2008 to 2010 inclusive, RBS was involved in providing finance worth almost €8 billion to companies listed as the world’s 20 biggest operators of coal mines and generators of coal-based electricity. The groups objecting to the sponsorship saw it as unacceptable for the bank to seek to gain some ill-deserved environmental credentials in the face of public criticism over its appalling record of fossil fuel finance.

In November when the news came out that RBS would not be continuing as sponsor for the 2012 Climate Week, it wasn’t clear who had dumped who – but safe to say it was a poor match from the very first date! It’s important to note that although RBS are no longer involved, there are still some controversial corporates on Climate Week’s arm. In particular EDF, which was recently convicted of carrying out industrial espionage on Greenpeace, base their core business in coal and nuclear power, and is driving rising fuel prices that are hitting the poorest hardest this winter.

But for RBS, it’s one less available greenwash opportunity – begging the question: ‘When will RBS step up to the real task of drawing up policies that limit finance of fossil fuel projects, rather than spending time and public money covering them up?’