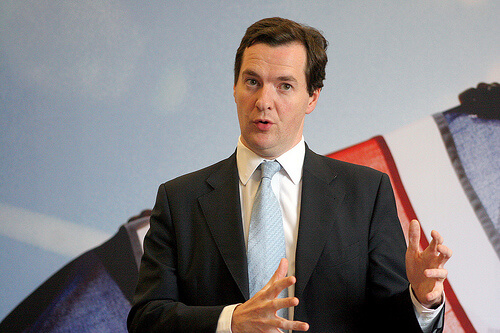

In April the Chancellor, George Osborne, launched his ‘Fair Fuel Stabiliser’. This linked the rate of tax paid by oil companies to global oil prices. When the price of oil was above $75 a barrel, the rate of tax on North Sea oil profits would rise, with the additional revenue used to lower the price of petrol and diesel. The measure is expected to raise £2 billion pounds over the course of the Parliament, although this is cancelled out by a £2 billion reduction in income from fuel duty.

In April the Chancellor, George Osborne, launched his ‘Fair Fuel Stabiliser’. This linked the rate of tax paid by oil companies to global oil prices. When the price of oil was above $75 a barrel, the rate of tax on North Sea oil profits would rise, with the additional revenue used to lower the price of petrol and diesel. The measure is expected to raise £2 billion pounds over the course of the Parliament, although this is cancelled out by a £2 billion reduction in income from fuel duty.

The Chancellor claimed that the stabiliser would raise enough money to avoid a planned increase in fuel duty, and also pay for a 1p per litre cut. This, he argued, would save the average driver £3 when filling up their car. The announcement followed a period of exceptional profits for the oil and gas industry, buoyed by oil prices reaching record highs.

The oil industry reacted furiously. Malcolm Webb, chief executive of industry lobby group, Oil and Gas UK claimed that, “this change in the tax regime will decrease investment, increase imports and drive UK jobs to other areas of the world.” Treasury Minister Justine Greening was reportedly “grilled alive” in a meeting with oil industry executives. A number of major oil companies announced plans to put investments on hold whilst they considered the impact of the new tax changes.

Using the threat of job losses and investment is one of the oldest tricks in the industry lobbying book. This two-part briefing by PLATFORM and Greenpeace examines the changes to North Sea tax and how the oil industry might not have it as bad as they are making it out to be, before considering ways in which the Chancellor may respond to the industry’s campaign against the changes.

Download the briefing (pdf)