While the Tory government forces through unpopular cutbacks to the NHS, education and pensions, British public institutions plan to invest hundreds of millions – if not billions – of pounds into new fossil fuel infrastructure on the Caspian.

Both the British Export Credit Agency (the ECGD – recently rebranded "UK Export Finance") and the Royal Bank of Scotland (majority-owned by the British state since its bail-out in 2008) have submitted proposals to the Azeri State Oil Company to finance a new oil & gas refining and petrochemicals complex. RBS & ECGD both have history in Azerbaijan, having financed BP's controversial Baku-Tbilisi-Ceyhan company.

The OGPC oil/gas plants – planned for construction in Garadagh just south-east of Baku on the Caspian shoreline – are estimated to cost around $17 billion, of which over 50% will be sourced from foreign investors and lenders. Apart from RBS and the ECGD, tenders were submitted by European banks Unicredit, Societe Generale, BNP Paribas, ING and Credit Agricole.

The new plant will also be partly financed by the Azeri State Oil Fund – an institution supposedly set up to reduce the likelihood of Azerbaijan being afflicted by the resource curse and Dutch Disease, by recycling oil revenues away from short-term projects & corrupt dealings and in theory diversifying the economy for future generations.

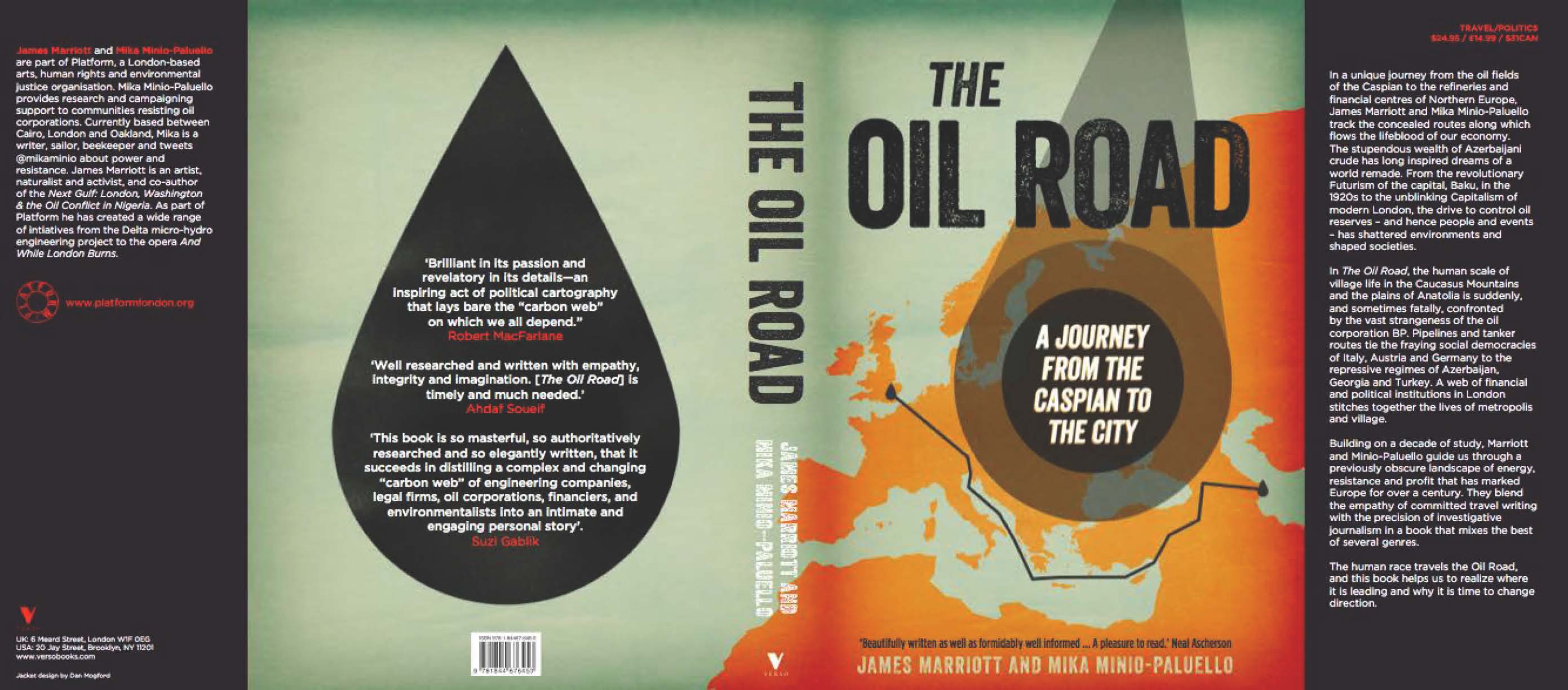

Platform's book The Oil Road – A Journey from the Caspian to the City – due out in September – reveals how President-Dictator Ilham Aliyev instead used SOFAZ to massively increase spending on his military and repressive police forces, while claiming to be managing oil revenues transparently and responsibly.

The Clean Up British Exports Campaign is challenging the ECGD's lending and finance guarantees to destructive fossil fuel and military projects. The Oil Road examines how British institutions have shaped the Azeri oil industry and political economy since the late 19th century, through military occupation, geopolitical games and City finance.