After two years of impressive mobilisation by UNISON grassroots members across England, Scotland and Wales, the trade union has officially taken on fossil fuel divestment policy.

Yesterday the union’s National Delegate Conference voted unanimously to

seek divestment of Local Government Pension Schemes from fossil fuels over five years giving due regard to fiduciary duty

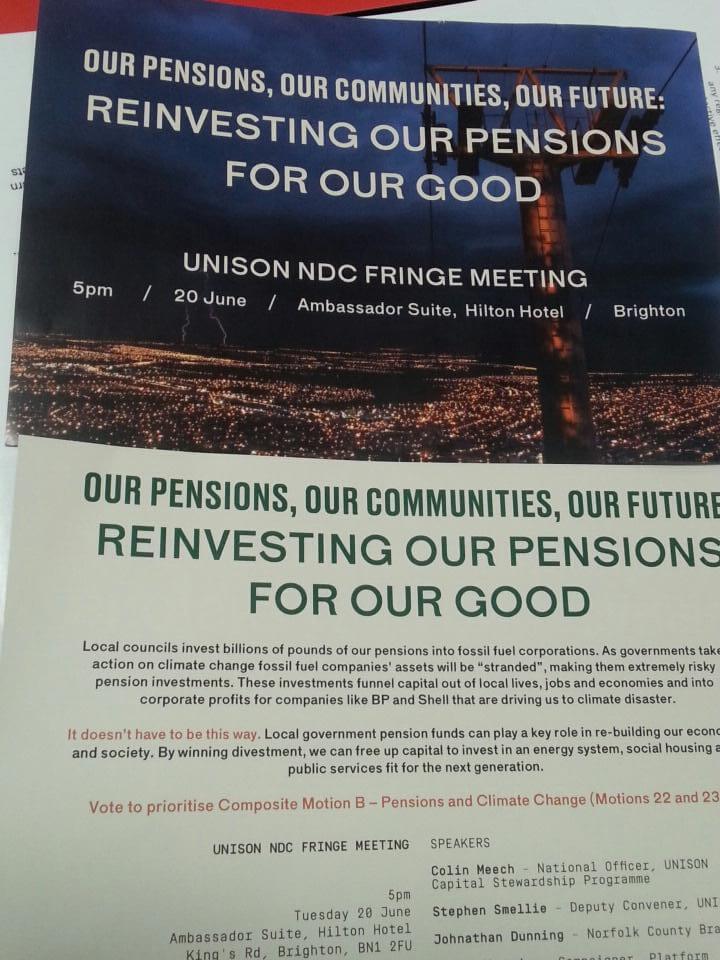

UNISON is one of the two largest trade unions in the UK, with over 1.3 million members, and the first to adopt formal divest policy. It is the primary representative for local government workers – whose pension funds are collectively worth over £200 billion – and UNISON representatives sit on boards of local government pension funds.

The divest motion clearly had widespread support – but it was a knife-edge whether it would make it onto a packed agenda of over 100 motions. Branches from across the country lobbied to give it priority – making it the last item debated on Thursday’s agenda.

Stephen Smellie, Deputy Convenor in UNISON Scotland, who brought the motion to conference, said

Our priority always needs to be to ensure our member’s pensions are protected. We are increasingly aware that investments in fossil fuels are not only harmful to the environment but put the sustainable future of our pensions at risk. Unison will now extend our campaigns to develop alternative investment strategies to enable pension funds to divest from fossil fuels over a number of years.

Local trade union branches across the UK have been promoting divestment. This specific motion was proposed by UNISON Scotland, Norfolk County, Camden and Southwark branches, with amendments from Hastings and Eastbourne Healthcare branches as well as the union’s National Executive Council.

Local government pensions in the UK are worth over £200 billion and are heavily exposed to fossil fuel companies. Our investigation in 2015 showed £14 billion invested in fossil fuels across local government pensions, with Greater Manchester’s pensions the most exposed with £1.3 billion invested (9.8% of its holdings).

We at Platform are thrilled to see UNISON joining the divestment movement. UNISON’s decision to divest shows that Exxon and Shell have no place in our future. Stranded fossil fuel assets threaten our pensions. And investing instead into clean energy, public transport, and social housing can kickstart our economy.

Local government pension funds have already started moving towards divestment from oil, coal, and gas. In 2016 Waltham Forest passed divestment policy, quickly followed by Southwark. Full and partial divest commitments already total £10 billion worth of local government pensions. Global divestment commitments total over $5 trillion.

Jonathan Dunning from Norfolk County Branch, who chaired a fringe meeting on Tuesday, also said

This issue was raised by a UNISON member as a matter of concern, so it’s great to see that individual concern debated and then agreed by the national union. Much work will now be needed to turn the fine words of the motion into real change.

Kev Allsop is UNISON representative to Greater Manchester Pension Fund – largest local government pension fund in the UK. He brought a motion to last year’s 2016 conference, when it wasn’t debated. He said,

UNISON’s National Delegate Conference, the trade union’s sovereign body, has today accepted that we should be making our pension funds carbon neutral. We have a very real opportunity to move £ billions out of Fossil Fuel extraction. UNISON now has the foresight to support investment into Sustainable Energy and Council Housing, creating jobs and much needed homes benefitting generations to come whilst reducing the cost of pensions to the taxpayer.