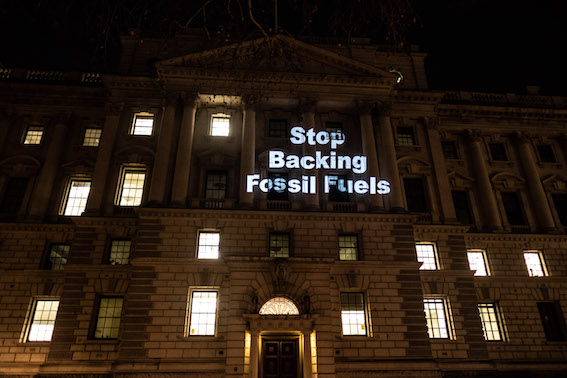

New data shows: last year the UK government supported oil, gas and coal projects in other countries to a tune of £1.8 billion – through UK Export Finance (UKEF), a government department that purports to support UK businesses operating elsewhere. We’ve analysed UKEF’s annual list of loans and financial guarantees, and here’s some of the things this public money will support:

- Singareni Collieries, a coal mining company in India. This at a time when the UK government has been proudly declaring its ambition to “power past coal”;

- Subsea equipment for Petrobras – the third part of a line of credit to the Brazilian oil company at the centre of a huge corruption and money laundering scandal;

- Several tranches of direct loans to GE and Siemens to build or upgrade gas power stations in Iraq.

To make matters worse, right after publishing this data, UKEF also confirmed another $500 million insurance package for an oil refinery in Bahrain. In its announcement, the agency explains that it considered various environmental and social risks associated with the project. The greenhouse gas emissions, astonishingly, were not one of the risks considered.

These loans and guarantees made up nearly a quarter of UKEF’s overall commitments for the year. How much did the agency support renewable energy projects, in comparison?

0.01% of UKEF’s commitments, or under £0.75 million.

That’s right: renewable energy received less than 0.0005 of the support that went to oil, gas, and coal. While Big Oil walks off with government handouts worth in the hundreds of millions of pounds, the biggest deal in renewables – to a provider of cables to an offshore windfarm – is worth just over £200 thousand.

But there was one fascinating U-turn in UKEF’s investments. You may remember that two years ago the UK government announced a new £1 billion credit line for UK businesses operating in Argentina, and then invited BP and Shell to a meeting in Buenos Aires to encourage them to apply.

What did UKEF support in Argentina in the following year (2017-18)? One oil drilling services company working for Pan American Energy (i.e. BP’s Argentinian arm).

In the same year, we showed up at UKEF’s headquarters with a fake fracking rig, leafletted every single person working in the building, hundreds of people signed our letter to UKEF calling to redirect this investment, a prominent MP wrote an article criticising UKEF’s approach to fossil fuels in general and to the Argentina credit line in particular, and two different Parliamentary enquiries challenged UKEF on fossil fuels.

What did UKEF support in Argentina in the year after that (2018-19)?

Two projects in road construction, and two exporters of magnets for research uses.

It may just be that public pressure is starting to work.

The parliamentary Environmental Audit Committee recently called on UKEF to end its fossil fuel investments altogether. Now is the time to end these dirty deals once and for all.

PS You can review the full dataset of UKEF’s investments and our analysis here.