In the wake of plummeting profits, spiralling exploration costs and increasing scepticism among other oil majors about commercial prospects in the US Arctic, pension savers across the UK are urging Shell shareholders to call on the company to abandon plans for high-cost, high-risk drilling projects in the US Arctic Ocean.

In the wake of plummeting profits, spiralling exploration costs and increasing scepticism among other oil majors about commercial prospects in the US Arctic, pension savers across the UK are urging Shell shareholders to call on the company to abandon plans for high-cost, high-risk drilling projects in the US Arctic Ocean.

The project is a shareholder activist push as part of ShareAction’s three year Green Light campaign, and is expected to see thousands of people email their pension funds and Shell’s largest shareholder – Blackrock – urging them to call for a change in Shell’s high-risk Arctic strategy.

Louise Rouse, director of engagement at ShareAction said: “Shell is the biggest shareholding in almost every UK pension fund. As such savers in those pension funds are exposed to the potentially catastrophic consequences of a major spill in the US Arctic Ocean. As shareholders these pension funds have the opportunity to express their views on company strategy. As the new CEO, Ben Van Beurden, prepares to deliver his vision for the future of Shell on 13th March, shareholders should demand withdrawal from a high risk project that requires a highly capital-intensive investment for uncertain return.”

Facilitating direct interaction by pension savers with their pension providers on issues like high risk Arctic drilling gives substance to recent policy measures to encourage more engaged and responsible share-ownership by pension funds.

Louise Rouse, director of engagement at ShareAction said: “This project demands that the investment community become more accountable to the people whose money they manage. In recent years, efforts to improve the way companies are run have focused heavily on making directors more accountable to their shareholders. But this is a job only half done. The logical next step must be for institutional investors to extend the same accountability which they expect from companies to the savers they represent.”

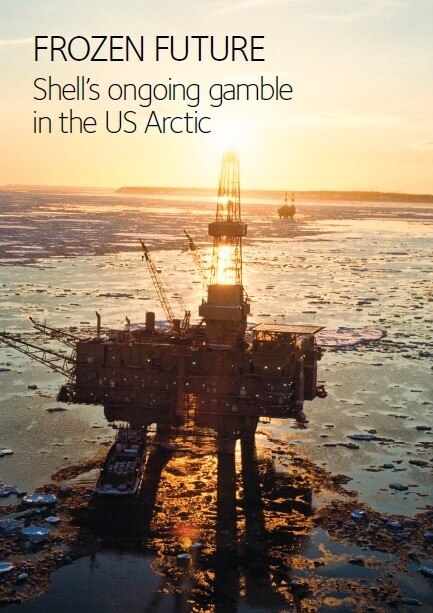

The action by pension savers accompanies the publication of a new report: “Frozen Future Shell’s ongoing gamble in the US Arctic” co-authored by ShareAction, Greenpeace UK, Platform, Oil Change International, Oceana, and Pacific Environment. The report explores the many operational questions that remain unanswered to the satisfaction of the US government and others, along with economic risks to Shell’s planned Arctic projects that remain unanswered to the satisfaction of financial analysts. These risks include:

• doubts over the level of commercially recoverable oil reserves when available public data suggests an uneconomical gas play;

• inadequate spill response capacity;

• concerns over contractor management; and

• ongoing litigation.

Charlie Kronick, senior climate advisor at Greenpeace UK said: “Now is a good time for Shell to change direction on the Arctic. There is a growing divide within the oil industry over the feasibility of Arctic Drilling, and other majors have walked away from what they now recognise was a bad bet.”

Anna Galkina, researcher at Platform said: “The recent court judgement following a lawsuit by Alaska Native and environmental groups was the latest setback in Shell’s plans to drill in the US Arctic Ocean. It’s highly doubtful that the many risks associated with this project are worth taking from an environmental, human rights, or financial point of view. Shell’s shareholders should challenge the company’s continued focus on this high risk project.”

The action tool for people to email their pension funds or Blackrock is live from 00:01 Tuesday 25 March 2014 here https://action.shareaction.org/arctic