Search

48 RESULTS

-

Share price of BP falling – will Shell take over BP?

As the London Stock Exchange opened at 09.00 on Tuesday, 16th December, BP’s shareprice was down to 365 pence. It was the bottom of a long slide from 448 pence on the 21st November and investors in the company looked concerned that BP was failing badly. Shares in BP have lost 25% of their value…

-

Russian Roulette. The impact of sanctions against Russia on international oil companies

This briefing by Platform, Greenpeace UK and ShareAction outlines the main European and US sanctions that impact IOCs operating in Russia. It details the impact of these sanctions on planned joint ventures involving Exxon, Statoil, Eni and Shell. It also examines the unique consequences for BP as a holder of a 19.75% stake in Rosneft…

-

Bill McKibben slams Shell sponsorship at elite climate conference #CHclimate

350.org’s Bill McKibben just gave a keynote address at Chatham House’s annual conference on climate change. Bill didn’t know it when he agreed to talk at the conference, but its headline sponsor is Shell. Here is what Bill said to a room full of “senior officials from businesses, government, NGO’s and academic institutions”: Shell is…

-

Shell AGM – Securing the comforts of the present generation at the expense of the next

Last week I headed home from the Netherlands, crossing the North Sea from the delta of the Rhine to the delta of the Thames, after having attended the Shell AGM in Den Haag with friends and allies from Greenpeace, ShareAction, Observatorio Petrolero Sur, Milieudefensie and Global Witness. This year’s Shell AGM was a quieter affair…

-

Stolen dreams and the small people – BP, Russia & Deepwater Horizon

I’d wanted to to attend the BP AGM, but confined to my sick bed I had to make do with following it online. Watching the company webcast, reading the transcripts of the speeches and, most vitally, following the brilliant live-tweets of my colleagues Louise Rouse of ShareAction and Charlie Kronick of Greenpeace UK. In part…

-

Sunday at Trafalgar Square: oil sponsorship meets Russian militarism

Short version of the story: poor timing of the year award goes to Boris Johnson for hosting a huge Russian Maslenitsa (pancake day) festival on the day Russian troops took over Crimea. Lead sponsor of the festivities: Russian state oil corporation Rosneft. Anyone has a clear idea why Mayor of London held Russian festival yesterday…

-

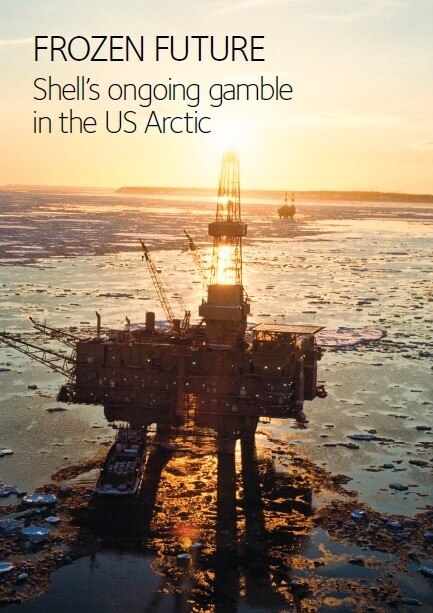

Why we’re telling Shell’s investors to tell Shell to stop Arctic drilling

A tricky, or should I even say embarrassing, moment in Shell’s history: on 31 October 2013 the company announced that they would be returning to drill in the Arctic in 2014, after all the mishaps and near-disasters of 2012. Three months later, they had to announce they wouldn’t be drilling in 2014 after all.…

-

Frozen Future: Shell’s ongoing gamble in the US Arctic

Royal Dutch Shell stands at a strategic crossroads. Its response to the reserves scandal in 2004 has been a global reserves replacement hunt through a programme of relentless capital expenditure, including an investment in US Arctic Ocean leases in the mid-2000s that dwarfed other companies’ spending. Shell’s US offshore Arctic plans have been a failure…

-

Shell shareholders urged to force Arctic retreat

In the wake of plummeting profits, spiralling exploration costs and increasing scepticism among other oil majors about commercial prospects in the US Arctic, pension savers across the UK are urging Shell shareholders to call on the company to abandon plans for high-cost, high-risk drilling projects in the US Arctic Ocean. The project is a shareholder…

-

Drilling the pre-salt – is Brazil still a “land of opportunity” for BP and Shell?

We are just days away from the fourth anniversary of BP’s announcement in 2010 that it was boldly going into the Brazilian offshore oil province, known in the industry as the ‘pre-salt’. Tony Hayward, BP CEO at the time proclaimed: “This strategic opportunity fits well with BP’s operating strengths and key interests around the world,…