Search

42 RESULTS

-

Russian Roulette: International Oil Company Risk in the Russian Arctic

International Oil Companies (IOCs) face pressure from investors to achieve a positive reserves replacement ratio. With governments around the world increasingly asserting control over natural resources in their territory, as well as conventional oil reserves dwindling, the Arctic is one of the frontier areas targeted by IOCs. In Russia, IOCs have entered a number of…

-

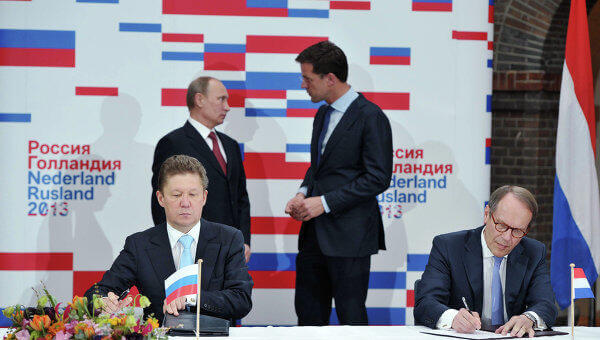

Shell and Gazprom sign more documents on Arctic tie-up

Gazprom and Shell signed a new agreement today, under the eyes of Vladimir Putin on his trade mission to Europe. The agreement has been in discussion for a few years; at one point a BP-and-Rosneft style share swap was discussed, but the two companies appear to have settled for a Joint Venture. Together they’ll extract…

-

The Russian roulette: Rosneft, BP, and the unknowns of Russian politics

TNK-BP, the British giant’s 50% joint venture with a group of Russian oligarchs, was bringing in about quarter of the firm’s production, and a lot of its political problems. BP’s solution: swap its shares in TNK-BP for cash and a near 20% stake in Rosneft, Russian state-owned company run by Igor Sechin, one of Vladimir…

-

Russian Roulette – the BP and Rosneft deal

On 22nd October BP plc announced it had agreed heads of terms to sell its 50% stake in TNK-BP to Rosneft. BP’s official announcement of the proposed deal refers to Rosneft’s 2011 oil reserve replacement ratio of 127% and dividend of 25% of IFRS net income. However, there are a number of areas of concern…

-

MPs find government support for Arctic drilling ‘reckless’

The UK government’s support for Arctic Oil drilling was labelled ‘reckless’ today by the Environmental Audit Committee (EAC). The Foreign and Commonwealth Office (FCO) has been quietly supporting oil companies’ Arctic ambitions but this is the first time there has been public scrutiny of the department’s actions in relation to Arctic drilling. The Committee published…

-

Shell Security Spending Data Mapped on Guardian Data Blog

Platform and the Guardian Data Blog have mapped Shell’s global security spending for 2008. The graphic is based on leaked internal financial data. You can find Platform’s full briefing on this issue here.

-

The Oil Road – Journeys from the Caspian Sea to the City of London

The new Paperback edition has a brand new Afterword… “★★★★★…The Oil Road opens the lid on the often-shady energy economy, weaving absorbing travel reportage into powerful investigative journalism…. If you want to know why oil matters, read this book.” – Time Out (book of the week) “An elegantly written travel book…will make you think the next…

-

Out in the Cold – new report on Shell’s plans in the Arctic

Shell’s Annual General Meeting tomorrow is unlikely to go calmly. The company’s problems range from anger over excessive executive pay to spills in the Niger delta. At this time, Platform, Greenpeace and FairPensions are putting to scrutiny offshore Arctic exploration as a key direction in the company’s strategy. The new report ‘Out in the Cold…

-

Out in the Cold: Investor Risk in Shell’s Arctic Exploration

Royal Dutch Shell’s plans for Arctic exploration are exposing investors to a ‘spectrum of risks’, this new report by Platform, Fairpensions, and Greenpeace warns. Download the report (pdf) and investor briefing or read online below. The report highlights Shell’s failure to address key concerns for investors and environmentalists: • Spill response plans are inadequate –…

-

Oil projects too far – banks & investors refuse finance for Arctic oil

West LB have decided not to finance oil & gas development projects in the arctic and F & C have dropped Arctic oil explorers Cairn from their ethical portfolio. The German corporate finance & investment bank, West LB, launched a new environmental policy in February and its guidelines are important in relation to the push…